Audimation Services has been acquired by Caseware International Learn More.

Katrina Kiselinchev, MBA, CPA, CFE, CIA

Big data has the potential to deliver valuable insights. Yet, according to a recent report issued by Forrester Research, most companies only analyze about 12% of their data. Why? An abundance of challenges, from an inability to access data housed in disparate systems, to size and complexity of structured and unstructured data.

In the world of big data, purpose-built data analytics tools have proven effective for examining large data sets to uncover patterns, errors, trends, potential fraud, and other critical business information. And if you’re looking to yield returns quickly, you should start by looking at areas where the dollars reside.

The world’s data is growing exponentially. Analysts estimate the world’s data volumes will grow by 50-fold by the year 2020 – reaching a staggering 40 trillion gigabytes. The variety of data also presents a challenge to professionals tasked with gaining insights from information.

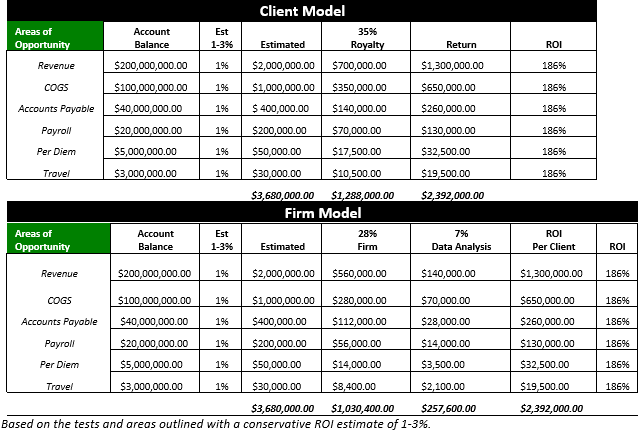

Data analytics has been around for 25+ years, and the players range from high-end solutions like SAS to lower-cost solutions like Excel. In my personal experience using data analytics, it’s possible to gain an ROI of 2,000% or more – if you know where to look. Fraud, waste, and errors can top several million within a large organization. Big data can yield big returns if you’re analyzing these prime areas:

The Association of Certified Fraud Examiners (ACFE) reports that 15% of all frauds involve expense reimbursements with the average time for detection being 24 months, and almost 90% of losses are unrecoverable. T&E frauds often go undetected due to high volumes of transactions and the inability to analyze only sample populations if the analysis is performed manually.

Employees with access to the company’s human resource database can easily create false employees, and in some cases, approve and reimburse travel expenses.

Fraud: $400,000K Over 5+ Years Period:

One of the most common types of fraud occurs within payroll processes. Fictitious or “ghost” employees can be set up within the salary system to receive automatic payments. For large organizations with high volumes and frequency of transactions, payroll data can be cumbersome to analyze manually. Data should be reviewed regularly to search for terminated employees who may continue to receive pay, excessive overtime or allowance claims, duplicate payments and other potential frauds.

Most payroll files have a master file with cumulative totals and static data. You will also need a monthly transactions file to conduct a full investigation of payments.

Most accounts payable frauds involve the manipulation of payment information such as the creation of fictitious vendors or suppliers, reactivation of a dormant account or the use of miscellaneous accounts. Accounts with high levels of transactions are particularly vulnerable to fraud, but data analytics is valuable in searching through high volumes of data to uncover schemes.

If you are importing from Excel, the date column needs to be formatted as a date type in Excel. You also need to check the box to Import empty numeric cells as 0 during the import into IDEA. If that does not work, save the Excel file as CSV (Comma delimited)(*.csv). Then use the Text import option in IDEA to import the .csv file. During the import process, be sure you define the date information as a date field type. If you are importing your data from Access, the date field data type needs to be formatted as a date/time field before you import. If you are importing a PDF or print report, be sure you define the date information in the Properties window as a date field type.

While the data analytics applications included in this article are highly effective for gaining ROI, they are just the beginning. From the expansion of services to contract negotiations and proactive fraud prevention, there are many other ways to improve your organization’s bottom line.

Most accounts revenue frauds involve the manipulation of sales information such as the creation of fictitious customers, inflated sales, fraudulent earnings, fraudulent bonuses, and post-period adjustments. Accounts with high levels of transactions are particularly vulnerable to fraud, as well as any areas that do not involve segregation duties. Data analytics is valuable in identifying trends, anomalies, and searching through high volumes of data to uncover schemes.

The Bottom Line Maximizer Data Analysis Program provides expert instruction and CPE credit to help professionals learn data analytics techniques for assessing risks, including which areas to test. The course uses actual data to demonstrate actual results achieved to maximize returns. Click here for more information.

This website has been designed for modern browsers. Please update. Update my browser now