Audimation Services has been acquired by Caseware International Learn More.

Truth can often be found in simplicity. The Association of Certified Fraud Examiners (ACFE) 2008 Report to the Nation on Occupational Fraud & Abuse cited that, “…occupational frauds are much more likely to be detected by a tip than by audits, controls or other means.” The report also stated fraud schemes often continue for years before they are detected. Such was the case with an east-coast company that discovered a six-year fraud scam, totaling $860,000 in losses.

Just as the ACFE report indicates, the $750 million company had its share of office rumors and tips provided during employee exit interviews. Since the company did not have an internal audit function, the CEO and CFO were notified and instructed accounts payable to investigate. Each time, the designated accounts payable “investigator” would report back to the c-suite that all was well and the rumors were simply spread by disgruntled employees. After six years of rumors and yet another exit interview tip pointed towards fraud in the accounts payable department, company executives turned to a Certified Fraud Examiner (CFE) to investigate the issue.

The fraud investigator applied an Occam’s Razor principle of simplicity and data analysis technology to his work by asking three simple questions:

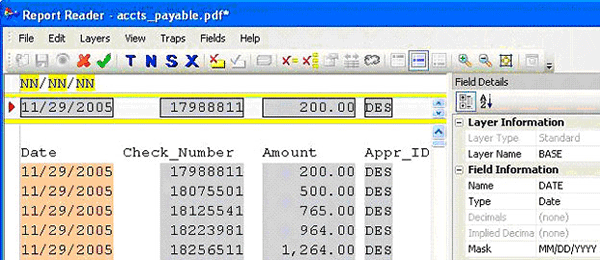

Armed with the information that there were five accounts payable employees, and the longest-term employee had worked for the company six years, the company provided six years of accounts payable data. The fraud investigator imported the data into IDEA – Data Analysis Software using a simple 10-step process, designed for importing PDFs:

Note: When you install IDEA on your PC, there are three comprehensive tutorials loaded onto your hard drive. Choose Start button ► All programs ► IDEA ► Documentation

Fig. 1. IDEA Report Reader – Create IDEA databases from PDF files

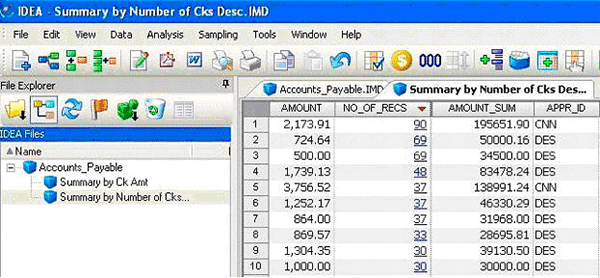

Fig. 2. PDF file imported into IDEA. Data can now be analyzed.

Once the accounts payable data was imported into IDEA, the fraud investigator summarized the data using the Amount field, showing the number of occurrences of each check amount in the six-year data file. The fraud investigator, together with the c-level executives, reviewed the results that very same afternoon and decided the best approach was to ask the company’s bank to re-image the checks appearing in the highest repeating check dollar amounts. Had they merely checked the accounts payable file, which of course contained the same data as the extract provided to the fraud investigation, everything would have appeared to be in order. The bank was instructed to look for patterns, and if found, stop the re-image process and report their findings.

Fig. 3. File summarized by checks of the same amount.

The bank easily detected a pattern where many checks were made payable to, and were endorsed by, the accounts payable employee who had worked for the company six years. In that time, she had swindled an astonishing $860,000 from her employer. You guessed it – it was the same accounts payable employee the c-suite had tapped to investigate when rumors or tips of fraud occurred. The case clearly involved a separation of duties issue in addition to a deep fraud scheme. The employee was arrested and convicted for her fraud crimes. At that moment, the fraud investigator knew he had secured a “client for life,” and worked collectively together to put internal controls in place to help prevent future infractions. Since then, the fraud investigator has been called upon the client and associates of the client company to provide data analysis on other problems, beyond fraud-related issues.

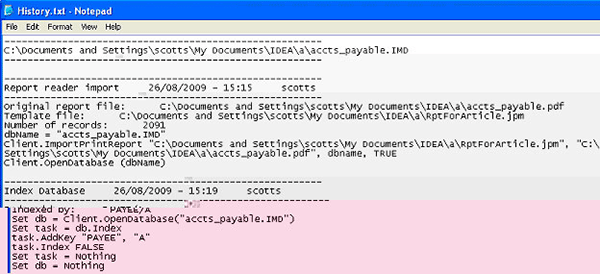

Fig 4. History of all operations performed while detecting fraud.

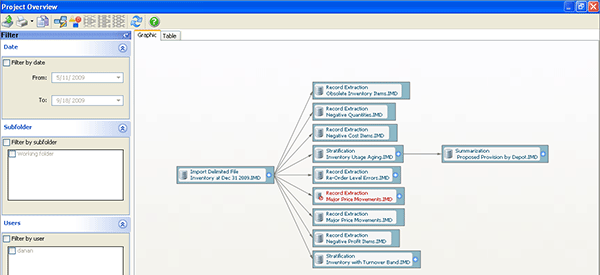

Data analysis tools can simplify the process of sharing audit findings with management or clients. IDEA Version Eight includes a Project Overview feature that presents a graphical representation of the entire audit or investigation process. The graphical overview includes all the actions performed within a Working Folder, including the creation, deletion, and modification of databases as well as recording all actions performed. It provides the ability to independently review the workflows including drill-down capabilities for additional history.

Fig 5. Project Overview

Simple approach. Big impact. Don Sparks (CIA, CISA, ARM), an experienced internal auditor and fraud detection expert concludes, “The take away from this real-world case study is that fraud investigators and auditors add value when they find anomalies not previously detected,” said Sparks, vice president with Audimation Services, Inc. “Consultants of any specialty have learned that nothing earns respect faster in the c-suite than the ability to inform management of facts they did not already know, but need to know.”

The fastest and most effective way to perform analytical procedures, such as summarization, which was used in this particular instance, is to harness the power of data analysis technology. Data mining and analysis tools like IDEA have been used by accountants, auditors and financial professionals for more than 20 years. They are designed to improve risk assessment, uncover fraud and identify control issues. Even if you pursue rumors or tips, and scan data for instances of fraud, imagine how much more you could find by using data analysis tools and techniques – simply by adding available technology to your knowledge of audit or fraud investigation work.

IDEA is a registered trademark of CaseWare International Inc.

This website has been designed for modern browsers. Please update. Update my browser now